Choctawhatchee Bay Water Sports

“I DID IT! FINALLY!” The exhilaration echoed across Choctawhatchee Bay as I conquered my first wakeboarding attempt, riding the smooth water with the boat’s pull. Born and raised in Fort Walton Beach, I have saltwater in my veins and have loved everything about being in or on the water since ...

Weather in Destin, Florida

Destin Weather Historical Data - 2023 Our guests keep asking us about weather in Destin, so here are the statistics before you book your vacation in Destin How is the weather in Destin in January? Average high is 60.0°F and average low is 37.0°F, with average 5.36 in rain, 6 ...

Craft Coffee Shops in Destin, Florida

We always get the questions about 'craft coffee shops', 'best coffee in Destin' and of course where is the nearest Starbucks. Best coffee can be subjective, and Starbucks is an easy Google search. Hence we will tell you about the crafted coffee in Destin. Maas Coffee Roasters Destin: A bespoke ...

Destin Okaloosa Fort Walton and Miramar Beach Beach Webcams

Destin and Fort Falton Beach Webcams are great ways to watch the weather and crowds before you begin your travel. Weather forecast may not always give the best idea, it may show rain but actual rain may be just an hour. So it is always fun to check different points ...

Destin Harborwalk Village

Destin Boardwalk is a 'must visit' Harborwalk village (a.k.a Destin Boardwalk) is in the heart of Destin, with a lot of attractions, restaurants and shopping. It stretches over the shore with its boardwalk, so it is a good venue to walk around. It also hosts the marina to all fishing ...

Tesla to open a supercharger station in Destin Florida

Tesla planned to open a supercharger in Destin, FL in 2020 plans, but then cancelled that plan. The latest news as of February 2024 that they're now building one between WinnDixie and Mimmos. News from 2018 below Good and long time awaited news. Today we have checked Tesla's Supercharger growth ...

EV Chargers for Vacation Rentals and Condominiums

Electric vehicles (EV) are becoming more and more popular. in 2022, 1% of the light vehicles driven are EVs in the US. With the sales projections, this number is expected to reach 45% by 2050. Thanks to their ranges getting extended, vacationers can now drive there to their destinations. The ...

Best Restaurants in Destin

Destin, Florida, is a coastal paradise known for its stunning beaches and vibrant culinary scene. Here are some of the restaurants we enjoyed in Destin, offering a diverse range of flavors and dining experiences: McGuire's Irish Pub: A local favorite, McGuire's Irish Pub is not only known for its hearty ...

Where to list your Destin Vacation Rental

Since I established my business Destin Condo Rentals by Owner to rent our Pelican Beach Resort Condos, I have listed it with several channels. Here is a comparison with my experience. I need to remind you that all channels will incur 3% credit card fees and also will not properly ...

Shopping Paradise: Exploring the Retail Wonders of Destin, Florida

Destin, Florida, renowned for its stunning white-sand beaches and emerald green waters, is not just a coastal paradise for sun-seekers. This charming city along the Gulf of Mexico offers an equally appealing array of shopping opportunities. From upscale boutiques and brand-name outlets to charming local shops, Destin's shopping scene has ...

Sip, Savor, and Soak in the Sunshine: The Tiki Bar at Pelican Beach Resort

Imagine sinking your toes into the soft, warm sand, listening to the gentle rhythm of ocean waves, and sipping on a perfectly crafted cocktail in a tropical oasis. Welcome to Pelican Beach Resort beachfront Tiki Bar, where relaxation meets paradise, and every sip is an escape. Nestled along the pristine ...

Exploring the Charm of 30A, Florida: A Coastal Paradise

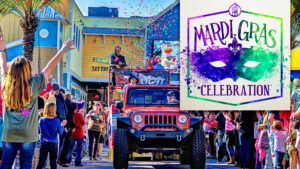

Nestled along the stunning Emerald Coast of Northwest Florida, scenic Highway 30A is a 24-mile stretch of coastal paradise that beckons visitors with its white-sand beaches, charming beach towns, and a relaxed atmosphere. This picturesque region has become a sought-after destination for those seeking a blend of natural beauty, outdoor ...

Big Kahuna’s Water & Adventure Park: A Tropical Oasis in Destin, Florida

Nestled along the pristine shores of the Gulf of Mexico, the emerald-green waters of Destin, Florida, are home to more than just sandy beaches and breathtaking sunsets. For thrill-seekers and water enthusiasts, the real gem lies in the heart of this coastal paradise – Big Kahuna's Water & Adventure Park ...

Pelican Beach Resort Beach Service Rates

Following are the 2024 Rental Rates for Pelican Beach Resort Beach Service. Our guests can use the free set we provide in our units. Personal sets are only allowed behind rental rows. Tents and canopies are not allowed on our beach. You can reserve your set by calling 866-651-1869 if you ...

Pelican Beach Resort installs new Level 2 EV Chargers in Destin

Pelican Beach Resort has EV chargers now. Opened on January 10th, 2023, chargers utilize the OK2Charge network and give the guests the opportunity to charge their electric vehicles overnight while staying in the resort. Two Level 2 J1772 chargers are installed on dedicated parking spots on the upper level of ...

A Coastal Oasis: Discovering the 10 Best Beachfront Resorts in Destin, Florida

Destin, Florida, is a sun-soaked haven nestled along the Emerald Coast, known for its pristine white-sand beaches and turquoise Gulf waters. For those seeking a luxurious escape with direct access to the Gulf of Mexico, Destin's beachfront resorts stand out as the epitome of coastal elegance and relaxation. Let's explore ...

A Guide to Traveling to Destin, Florida and Vacation Rentals

Destin, Florida, often referred to as the "Emerald Coast," is a picturesque destination that attracts travelers with its stunning white-sand beaches, crystal-clear waters, and charming coastal atmosphere. For those seeking a more personalized and comfortable accommodation option, renting condos can be an excellent choice. In this guide, we'll explore the ...

Discovering Paradise: The Allure of Crab Island in Destin, Florida

Nestled along the emerald coast of Florida, where the Gulf of Mexico's crystal-clear waters meet pristine white sand beaches, lies a hidden gem that captivates locals and tourists alike - Crab Island in Destin. This submerged sandbar turned floating playground has become a must-visit destination for those seeking sun-soaked adventures ...

Eternal Love and Endless Beauty: The Magic of Destin Beach Weddings

Nestled along the stunning Emerald Coast of Florida, Destin has earned a reputation as one of the most picturesque and romantic destinations for beach weddings. With its sugar-white sand, emerald waters, and breathtaking sunsets, it's no wonder that countless couples choose Destin for their special day. In this article, we'll ...

Discover the Vibrant Festival Scene in Destin, Florida

Destin, Florida, is known for its stunning white-sand beaches and emerald waters, but it's also a hub for exciting and diverse festivals. Throughout the year, locals and visitors alike can immerse themselves in the unique culture and vibrant spirit of Destin by participating in these fantastic events. Let's take a ...

Sandy Dreams: Exploring the Sand Castle Building Scene in Destin, Florida

Destin, Florida, with its crystal-clear waters and sugar-white sandy beaches, is a dream destination for beach lovers from all around the world. While sunbathing and swimming are popular activities here, one unique and creative way to enjoy the beach is by building sand castles. In recent years, sand castle building ...

Pickleball comes to Pelican Beach

Pickleball, a fast-paced and engaging racquet sport, has been gaining tremendous popularity in recent years. It combines elements of tennis, badminton, and table tennis, making it accessible and enjoyable for people of all ages and skill levels. One of the driving forces behind the sport's growth is the continuous innovation ...

Tee Off in Paradise: Exploring Golf Destinations in Destin, Florida

When it comes to golfing in paradise, Destin, Florida, is a golfer's dream come true. Known for its stunning emerald-green waters, sugar-white sand beaches, and a plethora of outdoor activities, Destin also boasts a variety of world-class golf courses that cater to golfers of all skill levels. In this article, ...

Pelican Beach Resort Stay Rules

Following are the rules published by resort management for our guests staying at Pelican Beach Resort, Destin Florida We are happy to have you as our guests! Below are our “Resort Rules” which we ask that you respect. Please take a minute to read them. SECURITY OFFICERS are empowered to ...

Rejuvenate and Rejoice: The Newly Renovated Fitness Center at Pelican Beach

Welcome to a new era of wellness and rejuvenation at Pelican Beach Resort! We are thrilled to announce the grand reopening of our state-of-the-art Fitness Center, which has undergone a stunning renovation to provide our guests with the ultimate health and fitness experience. Whether you're a fitness enthusiast or just ...

Phoenix, The Grand Canyon & Las Vegas in 5 days

In preparation for our trip, we had done extensive research on the places we wanted to visit and the route we wanted to take. We had also made reservations for accommodations, car rental, and all the activities we wanted to do. With our plan in mind and excited to start ...

Scuba Diving in Destin

Destin is a vacation destination unknown to many, at the Panhandle of Florida watching the Gulf of Mexico. Destin traces its immediate history to a fisherman, Leonard Destin, who moved here from New London, Conn., and settled in Northwest Florida about 1845. For decades, he and his descendants fished and ...

3 Effective Tips for Fishing from A Charter Boat

Fishing from a boat for the first time can be quite a mix of excitement and fear. While heading into deep water is a bit scary the first time, it need not be dangerous or overwhelming. The trick to getting comfortable fishing from a boat is to truly understand the ...

How much are Airbnb, VRBO, Homeaway Service Fees?

Book Your Destin Condo Without Booking Fees Online travel agencies dominated the market place and have been a fruitful platform for property owners while giving guests the comfort of real reviews and variety of vacation homes to choose from. The biggest ones in the market are Airbnb, VRBO/Homeaway and Tripadvisor/Flipkey ...

Great Vacation spots on Emerald Coast

There is great satisfaction in watching the sunset with sand lodged between your toes. That euphoria of ending the day in a paradise with the love of your life while doing the things you love is unmatched. Florida's Emerald Coast is a picturesque paradise compared to holidaying in the Caribbean ...

Underwater Museum of Art

The Underwater Museum of Art is the first permanent underwater sculpture garden in the U.S. Located in the Gulf of Mexico, off of Walton County, Florida. The museum lies at a depth of 58-feet and 1 mile from the shore of Grayton Beach State Park. Each year, a juried selection of ...

United Airlines ending service with Destin-Fort Walton Beach Airport

OKALOOSA COUNTY, Fla. -- United Airlines will end service to and from Destin-Fort Walton Beach Airport in March. United told Channel 3 Thursday that due to changes in the long-term sustainability of the particular route they will be ending discontinuing the route to and from Destin-Fort Walton Beach Airport. United ...

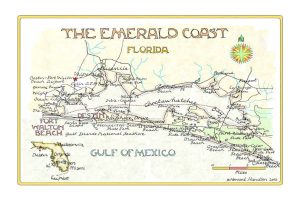

Pelican Beach Resort New Outdoor Pool now open

We are excited to give this great news. Owners of condos voted last year to build an additional outdoor swimming pool to replace the underutilized sun deck. The project began in February 2020 and because of COVID-19 a bit delayed, and opened in June 2021. The big pool area is ...

Southwest Airlines Service To Destin/Ft. Walton (VPS)

Beginning May 6, 2021, Southwest will commence service to an 11th airport in the Sunshine State, bringing a third option for beachcombers to access the Florida panhandle. Southwest Customers will be able to fly nonstop between Destin/Ft. Walton Beach and four destinations: Baltimore/Washington (BWI), Dallas (Love Field), and Nashville, bringing additional connecting or same-plane service to more than 50 cities, ...

COVID-19 Policies

Our standard cancellation policy is in effect for bookings done after 03/31/2020. Although not mandatory, Resort Management kindly requests guests to wear masks wherever they cannot socially distance (i.e. elevators) How do we clean our condos? - BathroomsClorox 4 In One Disinfecting Spray Clorox Clean-Up Cleaner + BleachClorox Toilet Bowl ...

Vacation Rental Income Tax

Let us first begin by the disclaimer that I am not a tax professional and my personal opinions may not be correct and does not constitute tax advice Having my vacation rentals at Pelican Beach Resort, Destin since 2016; I have been learning and learning about income return requirements What ...

Vacation Rental Owner’s Recommendations for Destin

You will see other blog posts here but these are our own recommendations in the area during your stay. You can also have huge savings by using the bookings system of our provide HERE. We strongly recommend a visit to Destin Marina and Harborwalk Village; there are nice restaurants with ...

Allegiant announces 5 new nonstop routes to VPS

DESTIN, Fla. Jan. 14, 2020 — Allegiant announced on Tuesday five new nonstop routes to Destin-Fort Walton Beach Airport (VPS). To celebrate, the company is offering one-way fares on the new routes as low as $33.* “Destin is one of the most popular destinations on the Emerald Coast,” said Drew ...

Winter is better than summer in Destin, Florida

For the ones who have never heard of or been to Destin, Florida; it is one of the most popular vacation spots on the Gulf Coast. It used to be a small fishermen town, not as small nowadays but still keeping its fishing activities. We own and manage 4 upscale ...

Brunch, Rhythm & Brews, February Sundays

Enjoy brunch and brews at Harry T's Lighthouse and Margaritaville, Destin with a live concert on the main stage starting at 2:00pm every Sunday, January 12th - February 23rd! January 12th | The Two HooDoos January 19th | Northwest Florida State College Jazz Band January 26th | Metz Barnes and ...

Palm Springs & Joshua Tree

Hiking under the desert sun may not be your favorite vacation but in case you decide to visit Palm Springs one day, I would strongly recommend that you do in May before it gets extremely hot. We took advantage of Memorial Day to make a week long trip. After flying ...

How to Choose Rental Condo Property

No long time ago, but in July 2016, I decided to buy a condo in Vacation Rental in Destin, FL. Before that, I have been long time doing my due diligence to buy a long term rental in DFW are in North Texas, however the calculations were solid that I ...

New Year’s Eve | 5 Parties on the Harbor – December 31

Ring in the New Year with 5 Parties on the Harbor! Ball Drop Countdown Fireworks at 8:00pm and MIDNIGHT M A I N S T A G E 7:00pm: Flash Flood 9:30pm: The Resolutions Starting at 10:00pm Harry T’s Lighthouse // Karaoke the Night Away Coyote Ugly Saloon- Destin // ...

Visit with Santa – December 21

Visit with Santa Celebrate the Holidays on the Harbor with free kid’s crafts, a Letters to Santa station and a visit with St.Nick every Saturday & Sunday through December 22nd! All of Santa’s guests will receive a special treat and a FREE 4×6 photo by SB Photos Biz. Throughout the ...

33rd Annual Holiday on the Harbor Destin Boat Parade December 15

Visit with Santa on the Main Stage from 1:00-4:00pm before the boat parade! The Destin Harbor will be dancing with holiday lights and cheer during the 33rd Annual Holiday on the Harbor Destin Boat Parade, starting at 6:00pm. Margaritaville, Jackacudas Seafood & Sushi and Harry T’s offer the perfect spot ...

Vervaco Cross Stitch Kits

A great hobby for isolation days These days are difficult for all of us. Especially keeping ourselves and our children occupied is the biggest challenge. Here is a great suggestion: Cross Stitch Kits, both for children and adults. Craftmar is a company importing the famous Vervaco Cross Stitch Kits from ...

Optimize (SEO) your vacation rental for search engines

I have been working on SEO for our Destin Condo Rental at Pelican Beach Resort website for a few years, and I did well. You will find a lot of articles on web about optimizing your web page, let me summarize the main bullets before giving some additional advice: The ...

Tapas & Tequila presented by Garden & Gun Magazine – March 8th

A weekend of culinary experiences and craft beverages begins on Friday, March 8th at 7:00pm with a Tapas & Tequila Kick-Off Party presented by Garden & Gun—- featuring Nashville band Humming House. Hosted on the Captain’s Deck, overlooking the Destin Harbor, enjoy an evening of delightful small plates and signature ...

Winter Concert Series – Feb 3/10/17/14

Spend Sunday Funday at HarborWalk Village! Tap your feet to the sounds of Joe Fingas from 2:00-4:00pm on the HarborWalk Village main stage. February 3rd | Joe Fingas February 10th | Choctaw High School Jazz Band February 17th | Bobby D Duo February 24th | Paradise Bayou ...

New Year’s Eve Street Party – December 31st

Ring in 2019 at HarborWalk Village’s New Year’s Eve Street Party featuring two live bands, two fireworks shows and a ball drop over the Destin Harbor! 7:00pm | Flash Flood 8:00pm | FIREWORKS 9:30pm | Departure- A Journey Tribute Band 12:00am | Balldrop & FIREWORKS ...

Christmas Dinner at Grande Vista Bar & Grill – December 25th

May your Christmas be Merry & Bright! Let the Grande Vista Bar & Grill do all the cooking at cleaning this year. Enjoy a special 3-Course menu featuring Corn & Crab Chowder, Prime Rib, Grouper and More. Reservations are highly recommended: 850.424.0621. Adults: $39 per person | Children 12 & ...

Holiday on the Harbor & the Destin Boat Parade – December 9th

The Destin Harbor will be dancing with holiday lights and cheer during the 32nd Annual Holiday on the Harbor Destin Boat Parade! Bring the kids to visit with Santa Claus starting at 1:00pm then at 4:45pm enjoy a special performance of the Nutcracker from the Ballet Conservatory of the Destin ...

12 Days of HarborWalk Holidays – December

Sunday, December 2, 2018 | 1:00 pm - 8:00 pm Visits with Santa & Movie Night Bring your list and check it twice! Visit with Santa on the main stage from 1:00-4:00pm and tell him all of your Christmas wishes. After your visit, drop your wish list in our special ...

Santa’s Magical Arrival to HarborWalk Village, Nov 25-26

Bring the family to see Santa arrive at HarborWalk Village Nov 24th at 12:00pm! Celebrate with us as Santa & Mrs Claus make their grande entrance Saturday at noon to HarborWalk Village kicking-off the Holiday Season! Visit with Santa all weekend long to receive a special treat and a free ...

40th Annual Destin Seafood Festival, Oct 5-7

Come join us October 5-7, 2018 along the Boardwalk for a great weekend of seafood, live music, arts and crafts, and family fun. This three-day festival is full of arts, crafts, music, food, entertainment, fireworks, and excitement for all! FRIDAY: 4pm -10pm SATURDAY: 10am – 10pm SUNDAY: 11am – 4pm ...

70th Annual Destin Fishing Rodeo (October 1st – 31st, 2018)

Come join us at the 70th Annual Destin Fishing Rodeo. Weigh-Ins are everyday behind A.J.’s from 10 am – 7 pm. Shark Saturdays (Every Saturday) Hang ‘Em High is the slogan of Shark Saturday! Book your shark hunt today! Every Saturday in October is Shark Saturday. We anticipate seeing some ...

Pumpkinpalooza: Children & Pets Costume Contest Oct 28th

Enjoy an afternoon of fun with your kids at HarborWalk Villages Pumpkinpalooza Candy Crawl and Mutt Strut! Fun for the whole family, including four-legged members, is happening as HarborWalk Village celebrates Halloween from 2 – 5p.m. with our annual Pumpkinpalooza children and pet costume contest. Get ready to show off ...

Fish the Days, Rock the Nights, Saturdays Oct 13-17

Watch the winning catches of the 69th Annual Destin Fishing Rodeo hit the docks for daily weigh-ins from 10:00AM – 7:00PM. Then Rock the Docks all night long with free live music on the main stage at 7:00PM and a FIREWORKS CELEBRATION over the Destin Harbor at 9:00PM! October 13th: ...

Pumpkinpalooza: Pub Crawl & Adult Costume Contest Oct 27th

Why let kids have all the fun? Dress up for a night of fantasy and fun at HarborWalks scariest pub-crawl! The night of fright begins at 6:00pm with the Monster Mash pub crawl throughout the village. At 7pm, Tyler Livingston takes over HarborWalk Village’s main stage, to rock the night ...

Farmer’s Market at Grand Boulevard, Every Saturday

Start your Saturday at Grand Boulevard Farmers' Market! Fresh from the farm produce, milk, cream, butter, ice-cream, eggs, grass-fed beef, beef jerky, all natural-free range chicken, pork products and sausages. We even have Fresh local seafood, crabcakes, tuna and shrimp dips. There is homemade pita, hummus, veggie dips, hot sauces, ...

8th Annual Emerald Coast Duck Regatta, Oct 6th

Save the date for this year’s eighth annual Emerald Coast Duck Regatta on Saturday, Oct. 6 from at the Village of Baytowne Wharf at Sandestin Golf and Beach Resort benefiting Sacred Heart Hospital on the Emerald Coast Volunteer Guild. The event features fun activities for the whole family beginning at ...

Sugar Sands Charity Golf Classic, Destin. Oct 8th

Pre-registration party at Tommy Bahama Tommy Bahama Golf Shirt Golf & Lunch at Kelly Plantation Ditty Bag, awards & prizes! Events: Pre-Registration Party at Tommy Bahama on October 7, 2018 at 6:30 pm Lunch at 11:30 am at Kelly Plantation on October 8, 2018 Shotgun Start at 1:00 pm Dinner ...

Concerts in the Village, Destin. Sept 27, Oct 4, 11

Gates open at 6 p.m. Bring a chair, wine and picnic dinner or purchase dinner prepared fresh on site. Coke products and bottled water are also available No pets, drones or tables larger than two feet are permitted. Admission is $15 per person. Concerts are free for Mattie Kelly Arts ...

Labor Day Concert Sept 1&2

HarborWalk Village is sending our sizzling summer off with a bang! Live music all weekend long and fireworks over the Destin Harbor! Live Music: 7:30pm Saturday, Sept.1st: Paris Avenue 6:15pm Sunday, Sept. 2nd: Georgia Clay Band Sunday: Fireworks: 9pm Just Add Fire: Firespinner (Main Stage): 9:15pm ...

HarborFest Sept 28th 5-9 PM

Discover the Luckiest Fishing Village in the World and enjoy gulf-to-table fare from your favorite local restaurants, as well as a tasting of local and regional craft brews at the 1st Annual HarborFest Celebration, September 22nd from 5:00pm – 9:00pm. Enjoy an evening of sipping, savoring and shopping your way ...

Memorial Day Concert Celebration May 26-27

Celebrate Memorial Day at HarborWalk Village! Its time for flip flops, sun tans and SUMMER! Kick-off summer with live music all weekend long and FIREWORKS over the Destin Harbor. 5/26 | 7:00- 9:00pm Flash Flood 5/27 | 7:00- 9:00pm Departure- Journey Tribute Band 9:00pm Fireworks followed by Fire spinning with ...

Let Freedom Ring | An All-American Tribute – Thursdays May 31 to Aug 16

elebrate Americana and the heritage of the Destin Harbor all summer long every Thursday night until August 16th. The all-American celebration includes a one-of-a-kind WWII Vintage Airshow, Live On-stage Entertainment, and FIREWORKS over the Destin Harbor, followed by ‘Just Add Fire’, a unique fire spinning performance. Price: Free Entertainment: 6:30 ...

Fat Tuesday Parade Kickoff May 29-Aug 14

Who wants some beads?! Join us for Fat Tuesday every Tuesday during the summer until August 14th as HarborWalk Village transforms into ͞The Big Easy͟. Enjoy dazzling floats, colorful costumes, street performers and float riders tossing handfuls of beads and swag! Enjoy free live music on the main stage before ...

Cinco de Mayo Pub Crawl May 5th

6:00 PM - 11:55 PM CDT We're throwing a fiesta on the Destin Harbor Boardwalk! Grab your friends for the annual Cinco de Mayo Pub Crawl. With your pub crawl pass enjoy exclusive drink specials all night long at all the festive stops ...

Best Gulf Coast Vacation

The beaches of the Gulf Coast are some of the best in the United States. Consistently ranked as a favorite among beachgoers, the coast along the Gulf of Mexico is known for its white, sugar-sand beaches and calm emerald green waters. Access to the water is found in beach towns ...

Emerald Coast Boat Show March 2-4

Whether you’re looking for a center console fishing boat, pontoon, cruiser, or even a luxury motor yacht, we've got the best selection in the Panhandle. And with the boat show season upon us, take advantage of boat show savings and incentives. So let this be the summer you remember with ...

Bubbly Baytowne March 15th

Time: 5:00 PM - 7:00 PM CDT Website: http://www.baytownewharf.com Bubbly Baytowne is back! Join us for an evening full of FREE champagne and shopping during our Bubbly Baytowne. Sip and Shop through the village streets! Stop in various retail merchants as you enjoy a selection of premium champagnes ...

Boomin’ Tuesdays at Baytowne March 20th

Time: 6:00 PM - 8:30 PM CDT Website: http://www.baytownewharf.com Enjoy lawn games and inflatables in the Events Plaza from 6-8:30pm. Then watch as we light up the night sky with a breathtaking fireworks show over the Lagoon at 8:30pm! ...

New Orleans – Destin

Given that we would spend our summer this year in the US, we preferred to make a road trip from Dallas, TX to somewhere with crystal waters. We have a heard a few options: Padre Island, Galveston, Orange Beach and Destin. We decided to hit two birds with one stone ...

Fort Walton Beach Farmer’s Market until Nov 1st

The Downtown FWB Farmers’ Market will be open the 2nd and 4th Saturdays of every month year-round. The market opens at 8:00am and closes at 1:00pm and is held at the Fort Walton Beach Landing Park, 139 SE Brooks Street, Fort Walton Beach, FL 32548. Our farmers, artisan food vendors, ...

Hurricane Nate and Destin, Pelican Beach Resort

Pelican Beach Resort is a great place to choose when it comes to Destin. It is only 5 minutes drive to Destin and you still get the best sand and ocean in the area, staying on the beach. This year, we had two hurricanes, having a risk to hit Destin ...

Destin Fishing Rodeo, All October

Destin, Florida’s signature event and a tradition since 1948, this month-long fishing tournament gives anglers of all ages a chance to get in on the fun! Not an angler? Daily weigh-ins at A.J.’s Seafood and Oyster Bar provide entertainment in a harbor-front atmosphere you’re sure to enjoy. Over 30,000 anglers ...

CANCEL – Destin Seafood Festival, Oct 6-8th – Destin Vacation Rental

he gracious property hosts allowing a festival that hosts almost 70,000 guests in three days use of beautiful water front land and asking their full time tenants to accommodate the festival, is nothing short of amazing. In addition to the Destin Charter Boat Association that has kept this tradition alive, ...

Christmas in Destin

Christmas activities in Destin, Florida abound this holiday season. Events vary from harbor parades to breakfast with Santa. Here’s some of the many events you don’t want to miss: Santa – Each weekend leading up to Christmas, Santa Claus will be available to listen to all wish lists, main stage ...

Pensacola Seafood Festival September 29 – October 1

Pensacola seafood is some of the best in the world and the Pensacola Seafood Festival is the perfect place to enjoy it! This is one weekend in Pensacola Beach you will not want to miss. From September 29, 2017 through October 1, 2017 discover just how delicious our local seafood ...

Emerald Coast Fall Volleyball Classic Sep 27 – Oct 1

This annual Fall event brings teams from all over the US to compete in one of the best beach volleyball tournaments anywhere. Taking place at the Boardwalk on Okaloosa Island, on the sugar-white sands and beside the emerald green waters the area is known for. More details at www.emeraldcoastvolleyball.com/ ...